Dual-class of shares: with the proper framework, a benefit for all

The dual-class structure can protect minority shareholders and offer owners the independence to operate their businesses

Yvan Allaire | Financial PostA recent piece in the Financial Post (“Time for regulators to take major look at dual class shares”, Barry Critchley, May 14, 2015) reports on the cogitations of a law professor who proposes as an “optimal solution” to abolish existing dual class of shares and prohibit such capital structure at IPO time, no less!

Of course, that remarkable suggestion is based on the same lame arguments that were hashed, rehashed and refuted in countless articles. The buyers of these shares need protection as they are obviously ignorant, misinformed and when buying these IPO shares, “they are not necessarily turning their minds to the share structure”

And this pronouncement comes as the Canadian IPO market is coming out of its slumber with a series of highly successful new issues with a dual class structure (BRP, Cara, Shopify, Stingray).

Entrepreneurs and institutional investors know a few salient facts:

- Financial markets, and the stock market in particular, have changed greatly over the last twenty years; institutional investors and indexed funds represent a large percentage of all shares traded on stock markets (more than 70% in the USA, between 50% and 60% in Canada, although precise statistics are less available). These investors are usually quite savvy and know what they are buying.

- Entrepreneurs will not come to the market if it means becoming vulnerable to a hostile takeover (remember that Canada has one of the most favorable legal context for hostile takeovers), or being harassed on a quarterly basis for every decision that does not bring an immediate increase in earnings per share, or being targeted by “activist” hedge funds pushing hard to auction off their company.

- A dual class of shares is not a free lunch in Canada. Indeed, since 1987, the TSX requires that any company issuing a class of shares with multiple votes also adopt a «coattail» provision to ensure that all shareholders will be treated equally, should an offer be made to buy the shares of the controlling shareholder. This provision in itself eliminates the single most important source of inequality between classes of shareholders. Whenever a «coattail» provision is in place, there is no justification for paying a premium to the holders of multiple-voting shares, should these be converted into subordinate shares. As Magna had become public before 1987 (and thus grand-fathered), it was not subjected to the requirements of a «coattail», hence the astounding premium paid to the controlling shareholder. It is noteworthy that despite the surging popularity of dual class of shares in the USA, there is no equivalent «coattail» requirement for American companies.

- Both the Institute that I chair (IGOPP, in 2006) and the Canadian Coalition for Good Governance (CCGG, in 2013) have proposed similar frameworks to enhance the attractiveness of dual class of shares. In addition to a universal and rigorous «coattail» provision preferably enforced by the regulators (rather than by the TSX), that framework includes:

- A reasonable multiple of votes so that absolute control is achieved only with a sizeable chunk of shareholder equity owned by the controlling shareholder(s).

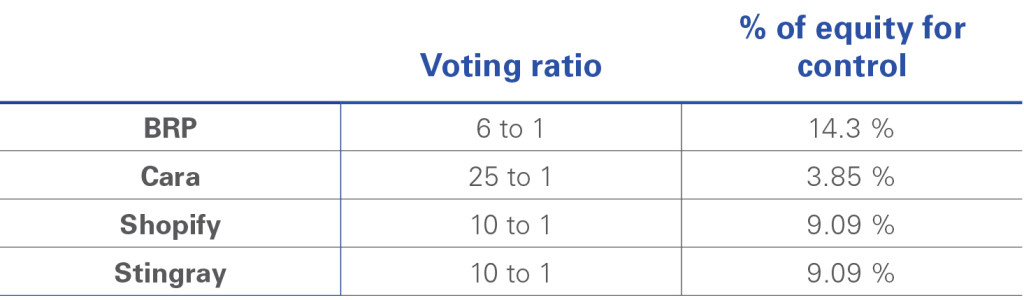

Both CCGG and IGOPP felt that a multiple of four votes would be appropriate as it calls upon the controlling shareholder to own 20% of the shareholders’ equity to maintain absolute control (50% of the votes). The recent IPOs have not observed that recommendation although the ratios, except for Cara, have been generally kept reasonable and certainly in no case is there a repetition of the 100-to-1 ratio of the Magna days:

- The class of shares with a single vote should elect up to a third of all board members. Controlling shareholders should exercise their power to elect directors only for the fraction of the board equivalent to their percentage of total voting rights, with a cap of two-thirds of board members elected by a controlling shareholder. Unfortunately that guideline was not observed by any of the recent IPOs.

- A sunset provision. A delicate issue with multiple-voting shares revolves around the advisability of setting a termination time or event at which point the dual-class structure would be collapsed into a single-class structure with all shares having henceforth a single vote. All of the recent issues in Canada have elected to adopt a variation of a particular form of «sunset» clause: the dual structure would be eliminated in the event that the controlling shareholders and their successors hold shares which represent less than 50% of all votes or some equivalent formulation.

Thus, it is quite possible to get the very real benefits of the dual-class structure and protect adequately the «minority» shareholders. If regulators feel the hitch to intervene on this issue, it would behoove them to adopt, and enforce for future IPOs, a framework along the lines proposed by IGOPP and the CCGG.